Disclaimer: The following blog is for educational purposes only and does not constitute official financial advice. The examples and resources provided are for informational use. We recommend conducting additional research or consulting with a financial advisor before making any financial decisions.

Why Climate Finance Matters in 2025

Climate finance is at the heart of the global response to climate change. As of 2025, the world is mobilizing unprecedented resources to support climate mitigation and adaptation, with wealthy nations pledging $300 billion annually by 2035 and aiming for $1.3 trillion per year to help the most vulnerable countries. Yet, the gap between what is needed and what is available remains significant, especially for low-income nations and communities in the Global South.

As individuals, our financial choices —such as where we bank, how we invest, and the projects we support —can collectively drive the transition to a low-carbon, climate-resilient future. Here’s how you, as The GREEN Program alumni, can activate your role in climate finance.

1. Activate Your Money: Bank with a Green, Climate-Friendly Bank

Where you keep your money matters. Traditional banks use your deposits to make loans and investments, and under the fractional reserve banking system, banks can lend out up to 10 times the amount you deposit, multiplying your impact. By choosing a green bank, your money is used to fund renewable energy, sustainable agriculture, and other climate-positive initiatives.

How to Get Started: Research what your bank is investing in now and switch to a green bank or credit union that aligns with your values. Green banks like Amalgamated Bank, Climate First Bank, and Clean Energy Credit Union are examples of institutions that prioritize environmental impact. Use resources like Green America’s Find a Better Bank tool to compare options.

Why it matters: Every dollar you deposit can be leveraged up to 10x for mission-aligned lending, amplifying your climate impact.

2. Understand and Establish Your Approach to Environmental Investing

Before investing, reflect on where you want your investments to sit on the Spectrum of Capital—from traditional investing (focused solely on financial returns) to value-aligned investing (considering environmental and social impact), to traditional philanthropy (prioritizing impact over returns).

Questions to Ask Yourself:

- What are your financial goals and risk tolerance?

- Which environmental or social issues matter most to you (e.g., renewable energy, clean water, sustainable agriculture)?

- Do you want to prioritize financial returns, measurable impact, or a balance of both?

Tip: ESG (Environmental, Social, Governance) investing has evolved to focus on materiality at the company or sector level, so you can tailor your approach to what matters most to you.

3. Create a Plan: Incorporate Environmental Investing in Your Portfolio

Set a three-month action plan to integrate climate-positive investments into your financial life. Consider the following asset classes:

- Cash: Keep funds in green banks or climate-friendly savings accounts.

- Public Equities: Invest in companies or funds with strong ESG performance.

- Angel Investing/Private Equity: Support early-stage climate tech or sustainable businesses.

- Private Debt: Lend to green projects or social enterprises.

- Philanthropy: Donate to organizations driving climate solutions.

Action Step: In your last session on the online course, you wrote down your goals and the steps you’ll take in the next three months to shift your portfolio toward sustainability. Revisit this goal and set an action plan.

4. Invest in Sustainable ETFs, Mutual Funds, and Retirement Funds

Sustainable investment options are growing, with assets under management in sustainable funds reaching $3.56 trillion by the end of 2024. While short-term performance can fluctuate, long-term data shows sustainable funds often match or outperform traditional funds.

How to Get Started:

- Use ESG ratings from Morningstar’s Sustainalytics to evaluate funds.

- Explore climate-focused funds like Carbon Collective or the Sphere 500, which is designed for 401(k) plans.

- Compare expense ratios and performance—some ESG ETFs have fees as low as 0.05%

5. Begin or Continue Your Environmental Lens Investing Journey

You can use a variety of accounts to invest with a climate lens:

- Retirement Accounts: Ask your employer or plan administrator about ESG or climate-friendly options.

- Liquid Assets: Move cash or savings to green banks or sustainable funds.

- Family and Community: Start conversations with family members, employers, or financial advisors about aligning investments with climate goals.

Resource: The Sphere 500 is a climate-friendly fund made for 401(k)s, making it easier to align your retirement savings with your values.

6. Get Started: Take Action with AskSustainable

If you’re looking for a step-by-step guide to eco-friendly finance, AskSustainable offers actionable resources to help you make informed decisions and take your first steps toward sustainable finance.

7. Going Global: How to Participate in the Indonesian Stock Market

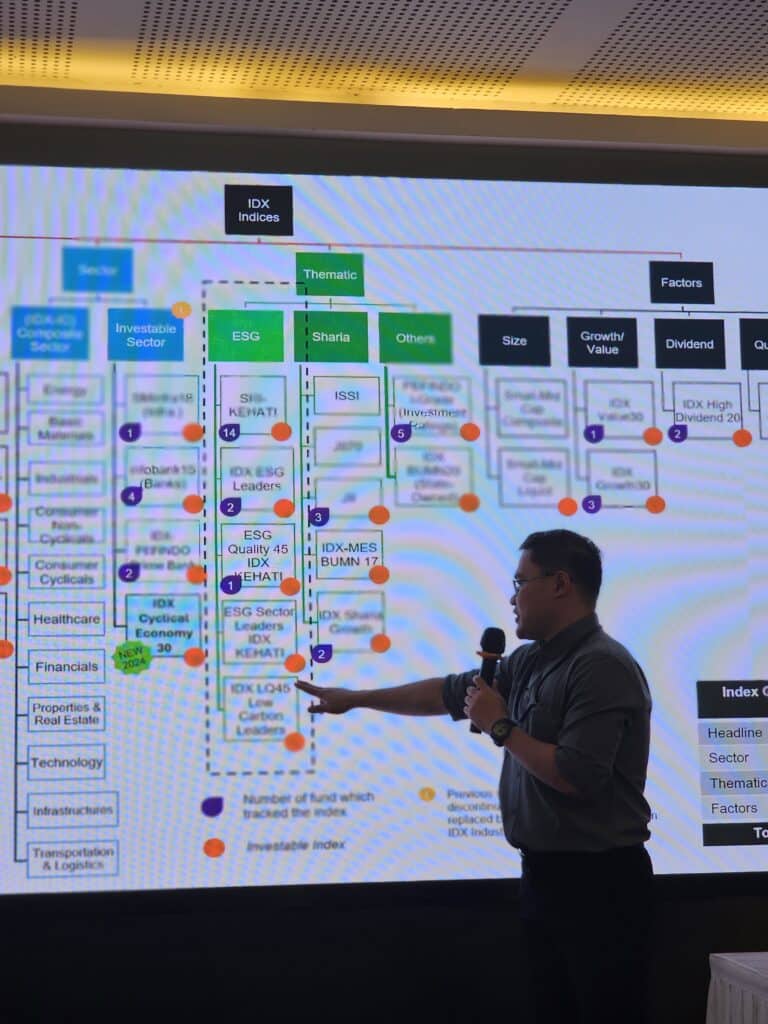

If you want to support climate action in Indonesia, you can invest directly in the Indonesian stock market:

- Open an account with a reputable securities house. Examples may include Stockbit Sekuritas Digital, Ajaib Sekuritas Asia, Indo Premier Sekuritas, Mirae Asset Sekuritas, or Mandiri Sekuritas.

- Once your account is set up, you can invest in stocks, mutual funds, and ETFs in Indonesia that align with your sustainability goals.

Note: The Indonesian stock market is robust and increasingly efficient, with both domestic and international players. Learn more: “Trading Stocks in Indonesia: A Guide for Foreign Investors”.

8. Participate in the Carbon Market: Support Indonesian Climate Initiatives

Indonesia’s carbon market is evolving, with new opportunities to purchase carbon certificates that fund local climate projects.

You can support initiatives such as:

Why it matters: Purchasing carbon certificates helps finance renewable energy and emissions reduction projects, supporting Indonesia’s climate goals. Before you purchase, learn more about the challenges carbon markets here by Carbon Better, and read this article, “What you need to know about Indonesia’s complex carbon market landscape”.

9. Consider Donating to Rumah Energi to Empower Rural Sustainability Initiatives

Rumah Energi is a leading Indonesian non-profit organization that supports financial cooperatives and sustainability projects in rural villages.

Your donation can help:

- Fund renewable energy projects (e.g., biogas technology and solar power)

- Support micro-financing for climate adaptation and mitigation

- Bridge generational gaps in cooperative participation through digital innovation

Learn more or donate at Rumah Energi’s website: https://www.rumahenergi.org/en/indonesiaberdaya-eng

10. Continue Sustainable Finance Action and Advocacy in the Global South

The C40 Cities Climate Leadership Group has developed a roadmap for sustainable finance action and advocacy in the Global South. This roadmap provides tools and policy recommendations for cities to access climate finance, advocate for enabling policies, and build partnerships with multilateral development banks

How you can help:

- Stay informed about global climate finance trends and challenges.

- Support organizations and policies that advance sustainable finance in Global South countries.

- Share knowledge and advocate for increased public and private investment in climate solutions

The climate finance landscape is rapidly evolving, and your actions, no matter how small, can have a ripple effect. By activating your money, aligning your investments, supporting innovative projects, and advocating for systemic change, you are part of a global movement driving the transition to a sustainable future.

Remember: This blog is for informational purposes only. Please do your own research and consult with a financial advisor before making investment decisions.

Ready to take your next step? Dive into the resources above, set your climate finance goals, and join the growing community of changemakers investing in a better world.

Interested in joining The GREEN Program for an upcoming immersive learning experience? Explore our next programs and Apply today!